Hey Friends,

Welcome to the 23rd edition of the Driver’s Seat! 🚙

📍 Today’s Lineup:

🌱 Pre-Seed Perspective in Chicago

🌽 Conquering the Midwest Market

📊 Chart of the Week

🗺 Events Around the City

🔙 Previous Issues of the Driver’s Seat

Before we dive in…

Make sure you’re subscribed to the Driver’s Seat 🚙 for the best info on Chicago's GROWING innovation economy 🙏

Let’s dive in! 🚙 🚙 🚙

🌱 Pre-Seed Perspective in Chicago

The pre-seed market has weathered the storm compared to venture investing at other stages.

As I’ve written about before, the “correction” that we’re witnessing is nothing but a return to normalcy from the craziness we experienced in 2021 and 2022.

Despite this correction, pre-seed companies have seen a 39% increase in invested capital compared to Q1 2021. (chart below)

In contrast, other stages have experienced noticeable declines.

This tells me is that TODAY is an ideal time to start a company.

In Chicago, investors are getting better about exploring earlier opportunities. There’s still more work to be done, but I see the recent proliferation of pre-seed / seed funds in our city as a move in the right direction.

Access to early capital is the unlock.

While the majority of early-stage investments are still concentrated on the coasts, our state has managed to secure a position in one of the upper quartiles of pre-seed investments so far in 2023.

In Q1 2023, Illinois saw over 52 investments (with the likelihood that some data might have been missed), signaling a positive direction for more pre-seed investments coming out of our state.

My vision is to continue increasing our early-stage efforts in Chicago, and I’m optimistic that our new pre-seed program will demonstrate the value of investing earlier.

At this stage, an investment of $500,000 remains significantly high compared to other amounts.

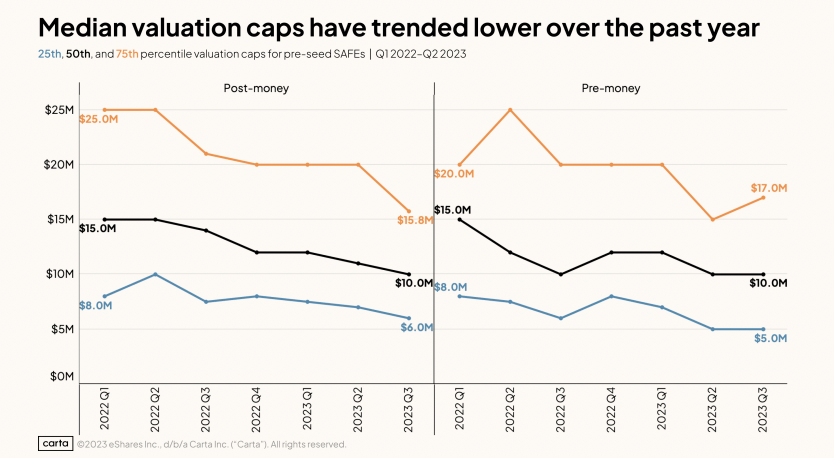

This is tied to the gentle decline of valuation caps we’re seeing (things going back to normal)

The median valuation cap for post-money SAFEs was $10M this past quarter, down from $15M at the beginning of 2022.

Advice for founders raising a pre-seed in 2023:

Find investors that match your needs.

True success in pre-seed involves unique theses and aligned founders. These investors offer valuable insights and connections.

Instead of common choices, opt for those who understand your space.

From what I’ve seen, we have a great group of investors in Chicago, many of whom are deeply invested into specific spaces and verticals.

Whether it be in foodtech, music, supply chain, or consumer, it’s essential that you (as founders) find investors who possess a keen insight into an emerging technology or platform shift.

Advice for Chicago investors in 2023:

We still have a lot of work to do to increase our early-stage efforts in Chicago, in order to keep talent here.

By investing earlier, we can retain our top talent and pave the way for the creation of more prominent companies in Chicago.

Along with supporting local founders, I believe that we should be doing more to promote Chicago as a great hub to founders in other cities.

As the third-largest city, we have a lot to offer!

Curious about Drive:

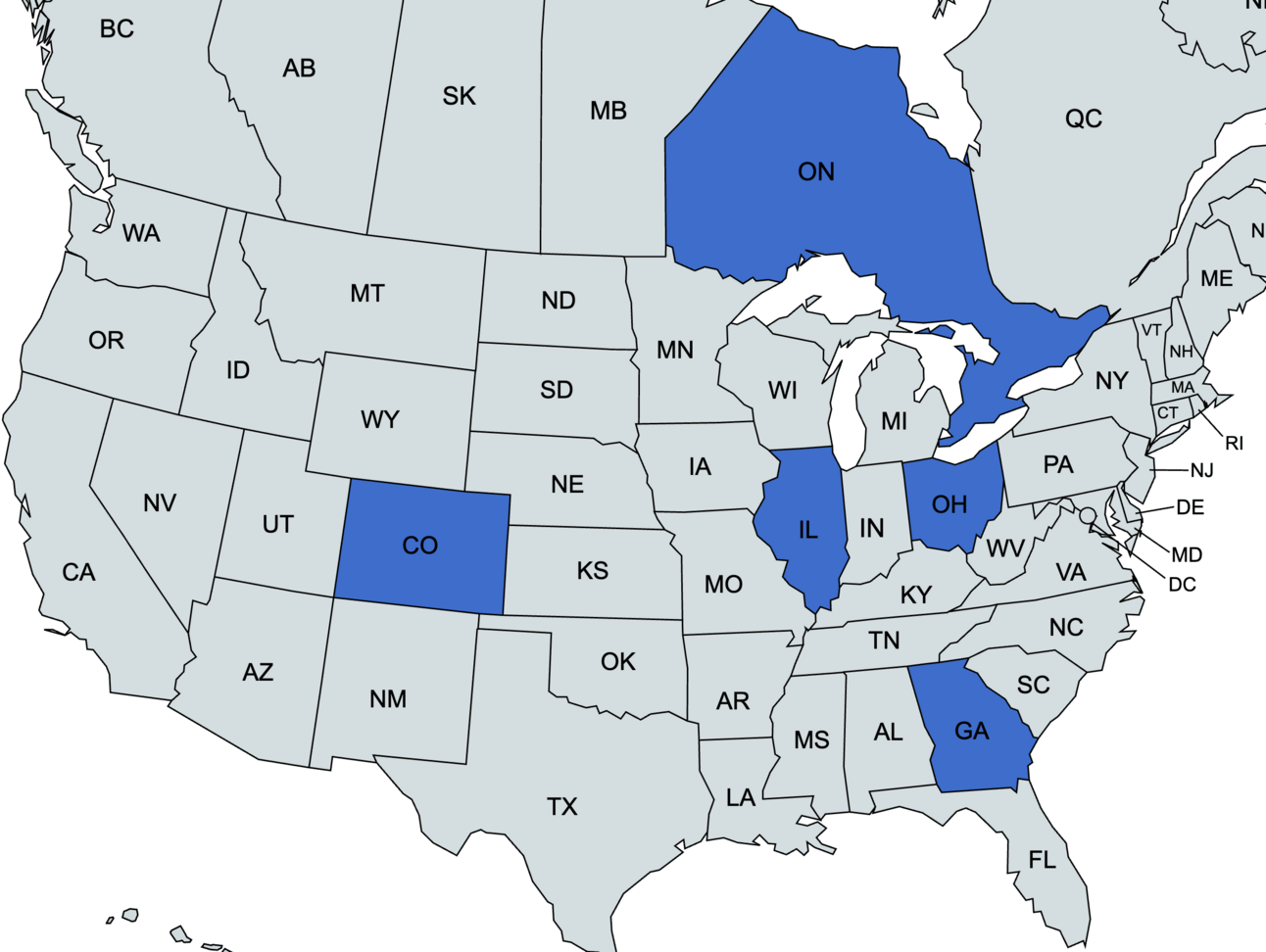

We’re currently running our pre-seed program in four select North American cities: Atlanta 🍑 Denver 🏔 Chicago 🏙 and Toronto 🇨🇦

Personally, my focus isn’t limited to Chicago — I’m dedicated to uncovering talented founders throughout the broader Midwest region.

My ultimate goal is for the founders we invest in from other cities to relocate to Chicago. We’re already seeing this play out in real time.

So if you’re an early founder in Chicago or the greater Midwest, check out our website!

For more of my thoughts on where pre-seed is headed in our city, I’ll be speaking at a panel this Thursday in our office 👇🏽

🌽 Conquering the Midwest Market

Every time I encourage founders to move their startups to Chicago, a primary selling point is the unique edge our entrepreneurs have in directly reaching their customers.

This is two-fold:

We have one of the highest concentration of enterprises in our region.

The essence of the ‘everyday American’ lives in the Midwest, rather than on the coasts.

Many established startups / founders have recognized this, even ones that ended up building on the coasts.

There's a well-known saying, "if it plays in Peoria," suggesting that more founders should consider the Midwest as a strategic focus, as it's an effective approach for achieving broad success among everyday Americans.

I draw a similar parallel for B2B / enterprise-selling startups when it comes to building in the Midwest.

Where else would you want to reach enterprise customers?

Chicago alone has 36 Fortune 500 companies, and the broader Midwest region is home to around 150+ of them.

These companies represent a diverse range of industries and sectors, all within the geographical reach of a Chicago-based startup.

By building your startup in the Midwest, you position yourself to tap into this rich pool of potential clients, making meaningful connections that can drive your enterprise to new heights.

Whether you're targeting individual consumers or B2B clients, the Midwest's business landscape offers a ton of opportunities for growth and success.

📊 Chart of the Week

Adding onto what I wrote about above, the below chart shows three additional reasons about why I’m bullish on the Midwest.

Manufacturing

Our manufacturing industry is the second largest in the nation; has a $99B annual output; employs over 410,000 people, and houses over 12,000 companies.

Talent

More computer science students are graduating in our corner of the country than anywhere else. In addition, more founders are starting companies outside of SV than ever before.

Research

The Midwest holds 19% of all U.S patents, with continued growth in areas like quantum and AI. The NSF is investing $500M over five years to establish 19 AI hubs through the National AI Research Institute. Four of these hubs are in the Midwest.

🗺️ Events Around The City

Next month at Drive Chicago, we're teaming up with our friends at Mantium and Redis for an AI Meetup.

We'll dive into strategies tailored for both startups / established businesses to effectively deploy generative AI solutions.

Make sure to sign up / learn more today! 👇🏽

Chicago Cyber Circle Meetup

Tuesday Aug 22

Jumpstart Demo Day 2023

Hosted by the Garage at Northwestern

Wednesday Aug 23

Making Chicago The Pre-Seed Capital with Landon Campbell

Hosted by Startup Grind

Thursday Aug 24

WMNfintech Showcase

Hosted by 1871

Thursday Aug 24

Fundraising Breakfast at WeWork

Hosted by TriNet

Thursday Aug 24

Fuel Up Friday with Andy Dunn

Hosted by Drive Capital

Friday Aug 25

Early Stage Fundraising Strategy for Healthcare Startups

Hosted by MATTER

Friday Aug 25

👋 See you next time!

Follow me on Twitter and Instagram for even more Chicago startup news and photos of my favorite restaurants in the city.