Hey Friends,

We’re BACK with the 18th edition of the Driver’s Seat 🚙

I’m fresh off TWO hackathons this past week!

I stopped by the Cameo HQ in Chicago to judge one of their internal hackathons.

Full circle moment since I was one of their first interns back in the day.

AND we also hosted our AI hackathon / announced the winner this past Wednesday.

Congratulations to the winning team: Janet Job Helper!

In one full-day, this team built an AI platform for non-profit workforce navigation.

Thanks to our subscribers that participated in online voting to help us decide the winning team.

I’ll be expanding the presence of hackathons in Chicago because we NEED more opportunities for our early-stage community to come together and BUILD!

Regardless of whether you're a dev, product lead, marketer, etc, my goal is to offer early builders the space to connect and create with like-minded people.

We have A TON of spectacular happy hours happening in Chicago, but it’s really time we see more hackathon / building-related events in our community too.

📍 Today’s Topics:

🌱 What’s New in Pre-Seed-Land

🏫 Midwest Grads Turned Founders

📊 Chart of the Week

🗺 Events Around the City

🔙 Previous Issues of the Driver’s Seat

Before we dive in…

Make sure you’re subscribed to the Driver’s Seat 🚙 for the best information on Chicago's GROWING innovation economy 🙏

Let’s dive in! 🚙 🚙 🚙

🌱 What’s New in Pre-Seed-Land

We hosted our Pre-Seed Between the Coasts event at the Drive Chicago office during TechChicago Week to discuss insights from the early-stage market.

Here are a few of the many points that were mentioned during a live panel:

2023 is a healthy correction, not an anomaly.

Some founders believe that today is the most difficult climate to get funding in.

They might be waiting for some sorta return to “normalcy” similar to what was experienced in previous years like 2021 and 2022.

However, it’s important to note that today's funding landscape IS NORMAL.

What we witnessed in 2021 and 2022 was not representative of typical circumstances, but rather existed in a realm of fantasy.

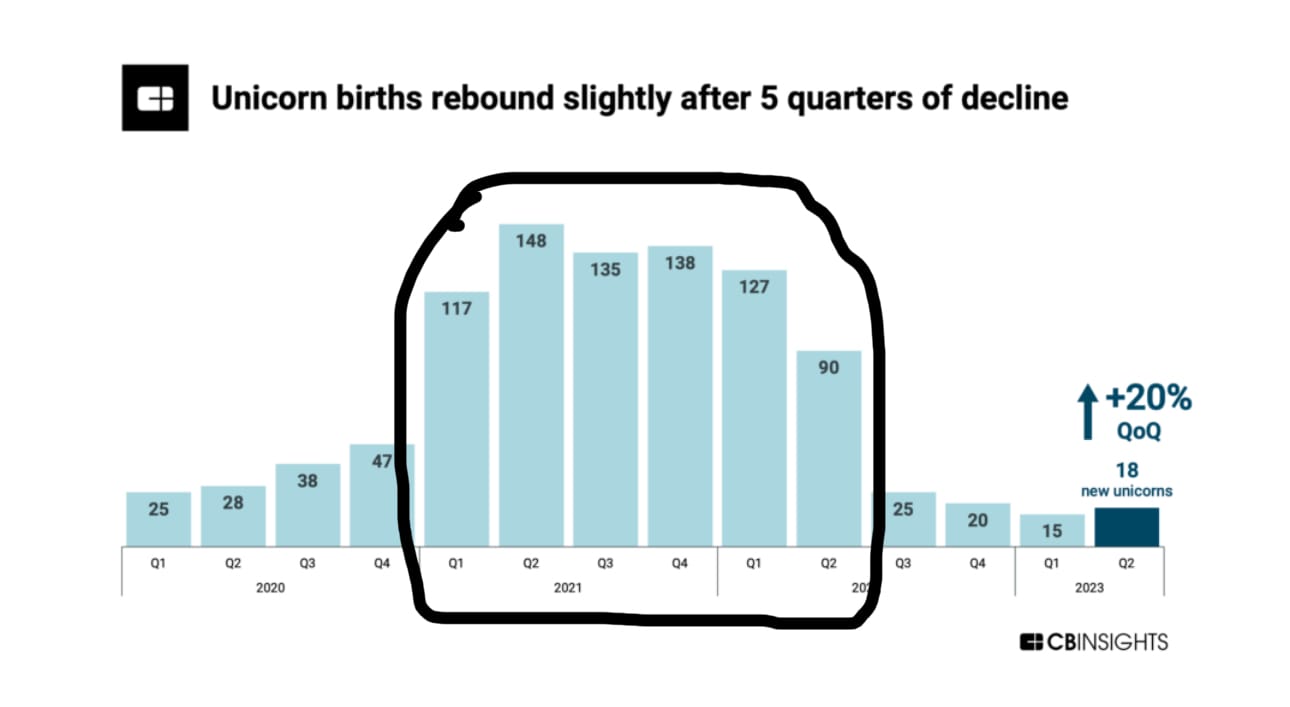

I mean c’mon… there was a point when we were seeing up to 150 unicorns minted in a quarter, term sheets would get sent and signed days after initial pitches, investors weren’t doing true diligence, and many Seed rounds surpassed $100M.

Myself and the other panelists of the event ensured our audience that deals are still getting done / checks are still being written, but the pace has slowed down and corrected to a true sense of normalcy. A bit closer to what is was before the craziness.

With this in mind, early-stage founders in 2023 should plan ahead for a different cycle than they might be used to.

Anticipate the need to engage with a larger pool of investors, be more intentional with how you craft your story, and focus on building leverage for your initial conversation with investors.

Go after traction, focus on retention, and come prepared to meetings with a unique insight about your market that proves your idea is worth building today.

If anything, seed valuations today are still fairly high. We covered this on the panel / predicted that valuations may continue to drop in the coming months.

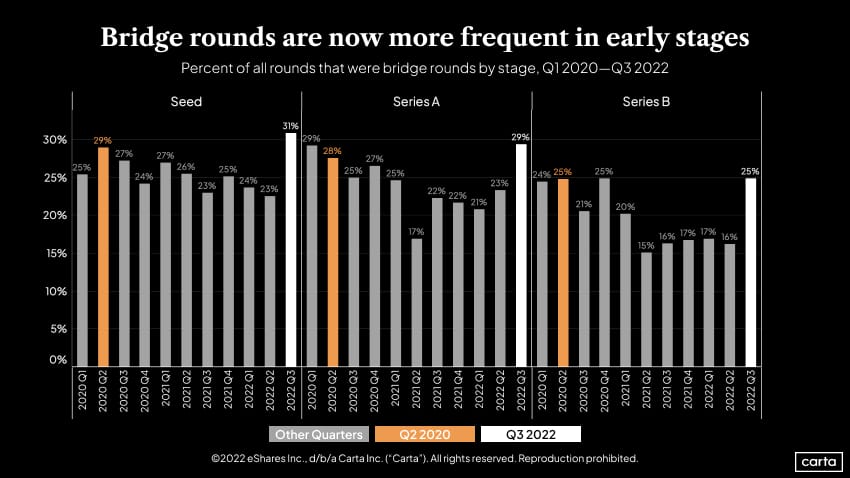

We also spoke about the rise of bridge and extension rounds that we’re seeing.

Instead of being able to secure an entire funding round, many founders have been compelled to prioritize assembling smaller rounds focused on key metrics and milestones critical for Seed or Series A funding.

Because of this, there are numerous startups in the pipeline that will approach investors for a full funding round later this year or early next year.

In the meantime, it’s essential for startups to strive to survive and thrive.

Adopting a resilient / adaptable approach, like a cockroach, rather than solely chasing unicorn status is recommended.

While it won't be easy, companies that can effectively utilize their bridge capital to weather the storm / successfully raise a substantial funding round will ultimately achieve success.

The last topic we covered on the panel was the importance of founders doing their own diligence on investors.

As a founder, make sure you do the work to find the best possible investor for your business. The decision of which investors you choose to partner with is a significant one for founders to make.

I believe that it's essential for early-stage founders to understand that the best investors offer more than just financial capital.

Great investors go beyond providing funding; they assist with critical aspects such as talent acquisition, helping to connect founders with relevant networks and resources.

The best investors offer guidance and support in navigating challenges, working collaboratively to overcome obstacles and achieve success.

With this in mind, don’t rush the decision. Take the necessary time to do your own diligence on investors.

Speak with their current portcos; ask the right questions; and be blunt about finding out what they are willing and able to do for you.

Put us to work!

🏫 Midwest Grads Turned Founders

Last week we covered well-known alumni at the University of Chicago that changed the world through their innovations.

This week, let’s take a look at Northwestern University

Penny Pritzker, the founder of PSP Partners graduated in 1984. The current portfolio has over $2B of acquired / developed multifamily and industrial assets.

Tech entrepreneur Andrew Mason graduated in 2003 and went on to create Groupon. His platform has over 49M active customers.

David Kabiller is the co-founder of AQR Capital Management, which is currently one of the world’s largest investment management firms, managing over $185 billion.

Monica Royer graduated in 2003 and went on to create the popular children’s brand Monica + Andy with her brother.

Hughes Network Systems' co-founder Steve Dorfman received his master's degree from Northwestern in 1965. He went on to build the satellite communications company that has played a huge role in delivering rapid internet services globally.

Next week, we’ll cover some well-known founders from Purdue University

📊 Chart of the Week

The Windy City has been on the cusp of the megacity mark for some time, as we should finally hit 10M Chicagoans in the next 10 years (currently at around 2.7M)

By 2030, it’s estimated that we should have the largest GDP of all new megacities.

A major catalyst for the increase of GDP will be the increase of population density in Chicago.

This visual shows just how dense our population is compared to another region in the US.

To match the scale of the population of the Windy City, we would need to add up every county in New Mexico, along with large portions of Colorado, Arizona, and Texas.

🗺️ Events Around The City

Startup Networking Happy Hour at Tony's

Hosted by Chicago Lean Startup Circle

Tuesday July 18

Lunch & Learn: Artificial Intelligence

Hosted by Gould & Ratner LLP

Tuesday July 18

Chicago Innovation Summit

Hosted by Chicago Innovation

Tuesday July 18

PostgreSQL Meetup

Hosted by Chicago PostgreSQL Meetup Group

Wednesday July 19

mHUB Community BBQ

Hosted by mHUB

Thursday July 20

Unleashing the Power of Branding in Go to Market Success

Hosted by mHUB

Thursday July 20

Gen Z Academy: Marketing to Gen Zers 101

Hosted by Gen Z VCs

Friday July 21

Reply directly to this email if you have a tech event you want featured in the Driver’s Seat!

👋 See you next time!

Thanks for making it this far! 😎

Follow me on Twitter and Instagram for even more Chicago startup news and photos of my favorite restaurants in the city.

Also please share the Driver’s Seat with others 🚙

🗞 Previous Issues of the Driver’s Seat

#15 - Onshoring in the Midwest