Hey Friends! 🚙

Welcome to the 33rd edition of the Driver’s Seat!

Highlights from Last Week:

We hosted a Neurodiverse Founder meetup in Chicago. 👇🏽

I visited the University of Illinois Urbana-Champaign to host two talks, meet with founders for 1:1s, and tour the Enterprise Works Research Center. 👇🏽

And this week I’m heading to Carnegie Mellon University to host our fifth AI Meetup on Campus 👇🏽

Fun fact, CMU was the birthplace of the :-) emoticon (amongst many other groundbreaking inventions) 😎

📍 Today’s Lineup:

🚨 Chicago’s New Tech Hubs

💰 Doing More with Less

📊 Chart of the Week

🗺 Events Around the City

🔙 Previous Issues of the Driver’s Seat

Let’s dive in! 🚙 🚙 🚙

🚨 Chicago’s New Tech Hubs

High Level Insights

Under the Investing in America initiative, the US Department of Commerce and EDA designated 31 new tech hubs, including two in Illinois.

Earlier this year, the EDA received a total of 378 applications for new tech hubs.

Each of the 31 hubs will receive between $40m and $70m for implementation towards talent and research.

Our New Hubs

The University of Illinois Urbana-Champaign will lead the iFAB hub, aiming to make Illinois a leader in fermentation, bioprocessing, and agriculture.

The Bloch Tech Hub, led by the Chicago Quantum Exchange, will focus on speeding up the adoption of quantum technologies across finance, medicine, and national security.

Out of the total 31 new tech hubs, 7 are located in the Midwest.

Why This Matters

Chicago's new hub announcements emphasize our strength and potential in Quantum and Agtech.

Agtech already contributes to 10% of Chicago's economy, and the Midwest has 5 of the top 10 US university AgTech programs.

40+ cents of every federal dollar being spent on quantum is happening in Chicago. In the past 5 years, institutions like the University of Chicago, UIUC, and Argonne Lab have poured over $50M into quantum infrastructure.

I’ve written about both areas more extensively below:

For more on the history of Agtech in Chicago.

For more on Chicago’s Quantum Leap.

💰 Doing More with Less

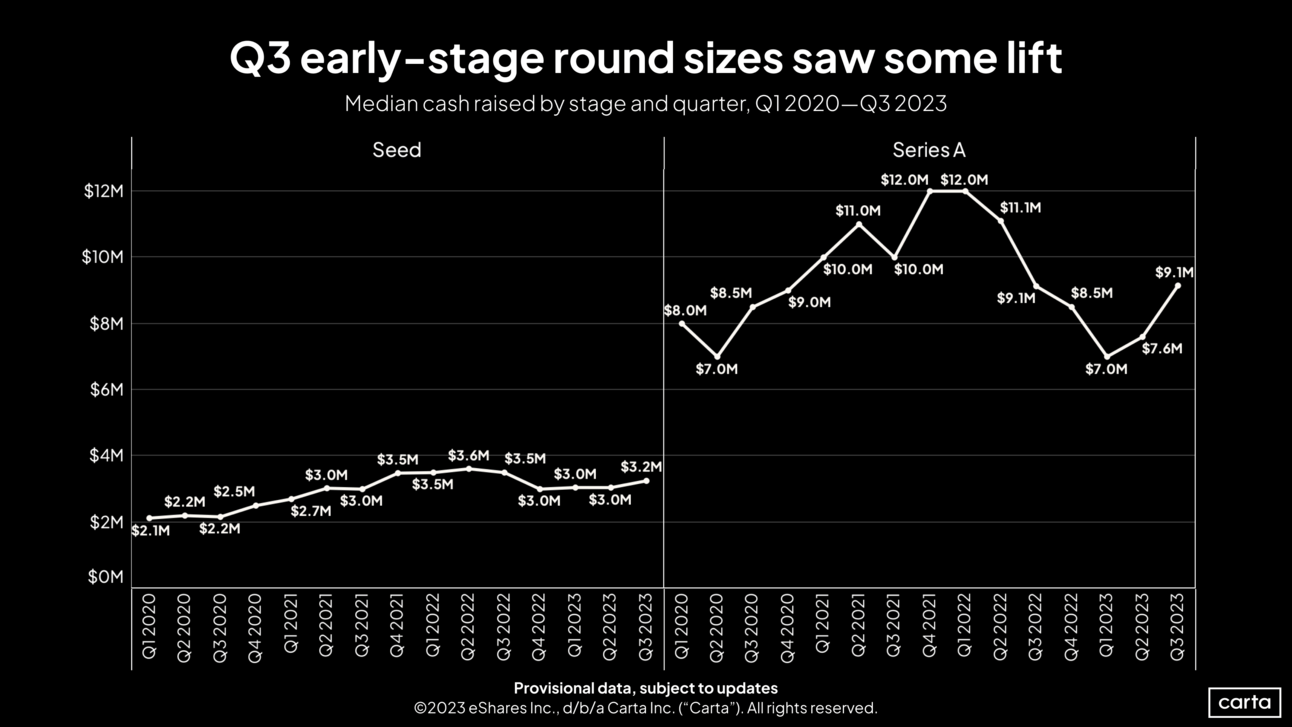

Seed valuations are still relatively high, which I think is dangerous for most early-stage companies.

In the initial stages of establishing a startup, I’ve seen too many founders spend too much time optimizing for the best price possible vs going after the right amount that makes the most sense for their startup.

Raising too much money early without knowing how you'll spend it can really hurt your startup. Capital constraints are good. Discomfort sparks innovation. And it’s better to use intelligence to solve problems rather than just throwing money it.

The journey of determining the right amount of capital to out into your business is a balance between resources / passion.

Overwhelming resources without the corresponding drive can lower potential. A well-timed inflow of funds ensures that the ambition / drive remain undiminished.

And of course, other than the harm of overspending, raising too much money early can lead to over-dilution.

How To Determine the Right Valuation

I recently found a list that breaks this process down in an effective way: 👇🏽

All in all, know what you need and optimize for that.

📊 Chart of the Week

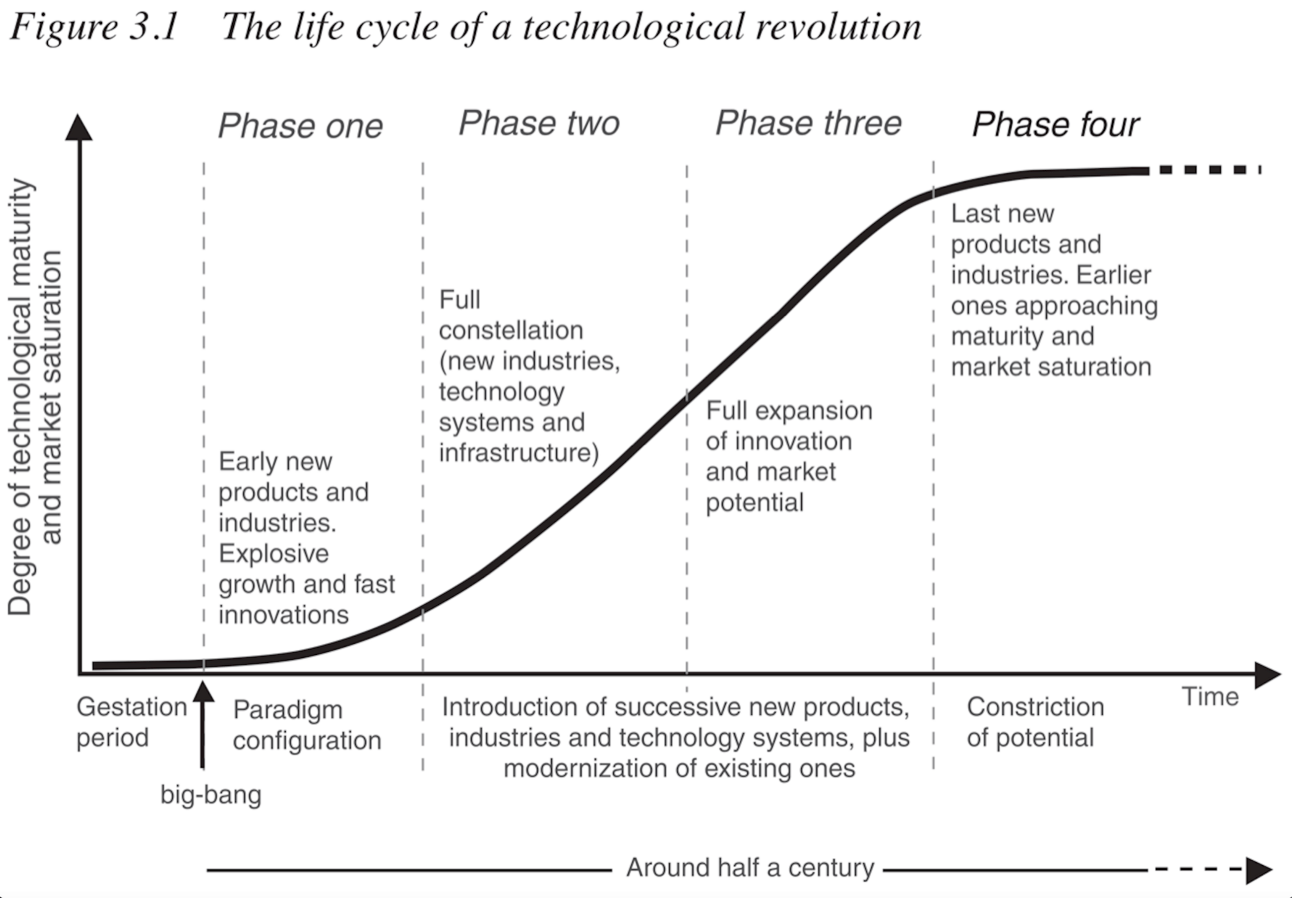

This is Carlota Perez’s Technological Revolutions and Financial Capital chart, which outlines the common pattern / cycle of technological revolutions from the past and present.

Perez's model breaks down each cycle into two primary phases: the installation phase and the deployment phase.

Installation spans from the beginning to the crisis, while deployment takes place post-crisis.

As she writes about, each cycle from the Industrial Revolution to the Age of Information followed a similar pattern:

Some critical factor of production suddenly becoming very cheap.

Some new infrastructure being built.

A period of innovation followed by a bubble.

A post-bubble recession.

A re-assertion of institutional authority.

And then a period of consolidation and wide spread of the gains in productivity from using the new technology.

Why This Matters

Things will always look and sound crazy until they’re normal. I feel like this model is very reminiscent with what we’re experiencing today in the age of language models.

We are currently in the irruption phase, and perhaps even in the frenzy phase This should excite founders living in 2023. No idea is too crazy.

Consider this a unique opportunity to completely rethink a common way of doing something.

This is where new business models are formed. Ones that are beyond our wildest dreams.

With that said, think different.

And if you have a ‘different’ idea, I’d love to chat!

🗺️ Events Around The City

In two weeks, we’re hosting our second AI Tinkerers event at the Drive Chicago office!

If you're passionate about creating LLM enabled apps and want to connect with folks in the space, then come on by! 👇🏽

-Momentum Class 3: Final Showcase

Hosted by MATTER

Tuesday October 31

Biz Development & Market Research

Hosted by the Polsky Exchange

Tuesday October 31

Chicago:Blend's 5th Birthday Party 🎉

Hosted by Chicago:Blend

Wednesday November 1

AI Revolution: Informing Public Decision Making

Hosted by 1871

Thursday November 2

VC Panel: The Future of Chicago Venture

Hosted by the Kaplan Institute

Thursday November 2

Closing the Gap: A Fireside Chat on Health Equity and Policy

Hosted by MATTER

Thursday November 2

👋 See you next week!

Follow me on Twitter and Instagram for even more Chicago startup news and photos of my favorite restaurants in the city.