✍🏽 Landon’s Loop #143

This week’s newsletter is supported by 1440 & University of Chicago Graham School

What’s in the Loop:

🎙️ Chicago Futurist Vol. 4 with Phil Mikhaylov, CEO and Co-Founder of UNICORN

📅 3 Tech Events in Chicago

🎓 Pathways to Grad-Level Computer Science at UChicago

🧠 Feed Your Curiosity with 1440 Topics

I start my day reading 1440 and I’m a big fan of their Topics product.

1440 Topics is a human-curated knowledge platform that blends the best of Wikipedia and Pinterest. Every insight is fact-checked, contextualized, and designed to respect your time.

Tim and his team built 1440 Topics after hearing the same frustration again and again. Curious people want trusted, vetted sources on topics they care about. So every day, 1440 editors find world-class explainers from places such as MIT, to fill the missing gap between that content and curious readers.

The long-term vision is to cover the ~10,000 most popular topics, representing 20% of all web searches, and deliver the best content across newsletters, podcasts, video, social, and live events.

Check out 1440 Topics

🎙️ Chicago Futurist: Phil Mikhaylov, CEO and Co-Founder of UNICORN

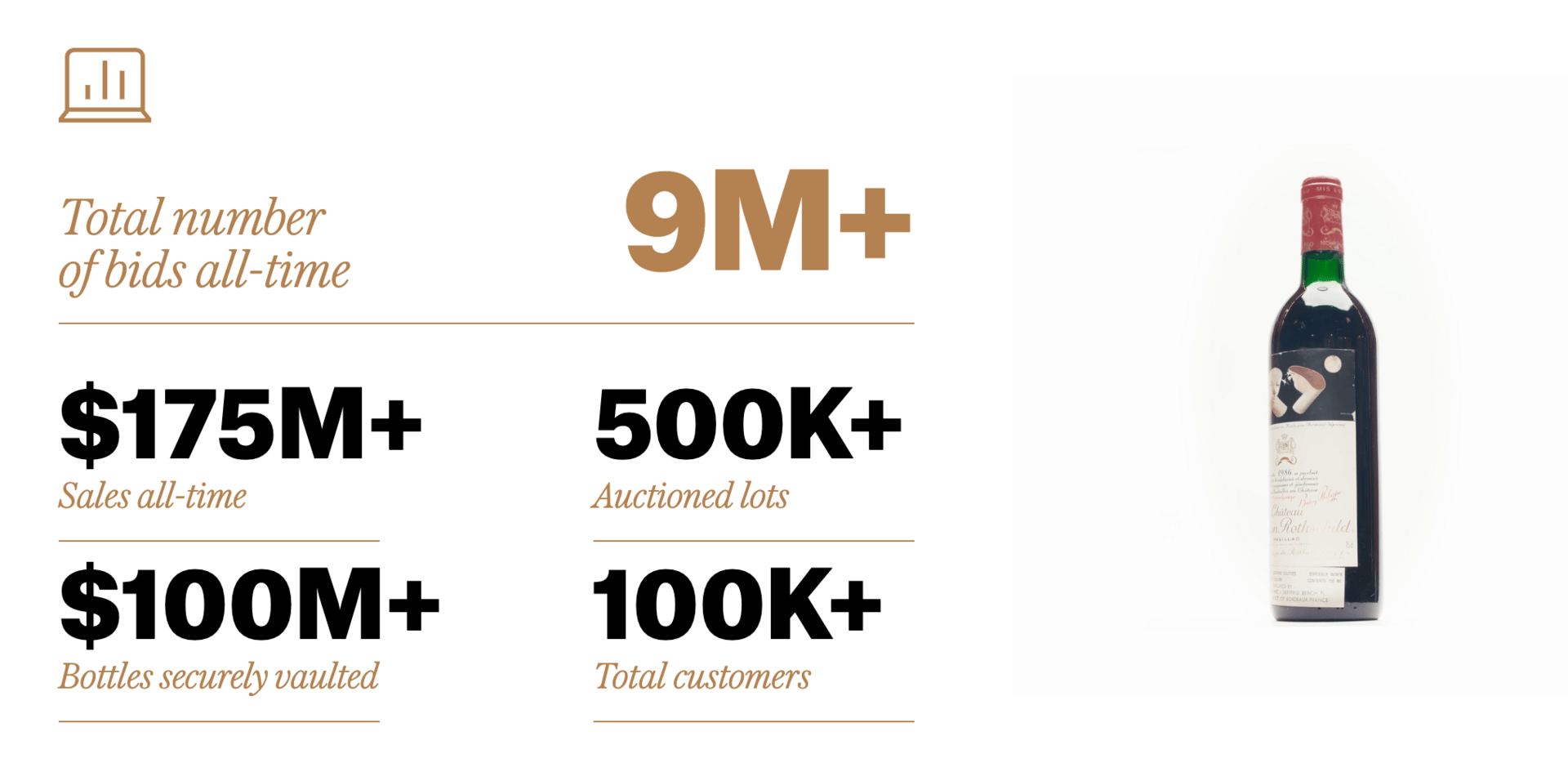

Phil Mikhaylov and his team at UNICORN are building the modern infrastructure behind buying and trading wine and spirits. I spent time with Phil at his Ravenswood HQ, where an operationally obsessed team is doing something that’s never been done before: bringing hundreds of millions of bottles online.

Here’s our conversation:

Before UNICORN, what felt broken about how people bought or sold wine and spirits

PM: Trust and access. Buying fine wine and spirits felt stuck in the past—opaque pricing, high barriers to entry, and access limited to “insiders” rather than consumers. Buying often required deep industry knowledge or personal relationships, while selling was slow, intimidating, and heavily skewed toward legacy intermediaries. We knew from day one that you couldn’t just “modernize” that system—you had to rebuild the entire experience from the ground up.

That meant creating transparent pricing, a centralized marketplace, rigorous authentication, and modern logistics, all wrapped in a user experience that felt intuitive whether you were a lifelong collector or just getting started.

Which lessons from your time at Uber shaped how you built UNICORN’s physical network

PM: Reliability beats optimization. It’s better to build a network that works the same way every time than one that’s theoretically more efficient but unpredictable in practice.

We focused on standardization, redundancy, and clear incentives, because consistency builds trust. Squeezing out the last 5% of margin matters far less than knowing a bottle will move safely, on time, and exactly as expected.

UNICORN is building trust in markets that historically didn’t deserve it. If we do our job right, people shouldn’t think about us as an auction house at all. We feel like infrastructure.

Under the hood, UNICORN is a data company. At what point did you realize you were building something much bigger than a marketplace

PM: Pretty early on we realized the auction was just the interface. The real value was in the data—understanding liquidity at a level that didn’t exist anywhere else in the market: what actually trades, at what price, how quickly, and under what conditions. Once you see enough transactions, patterns emerge that don’t exist anywhere else in the market.

At that point it became clear we weren’t just facilitating transactions, we were building the pricing and liquidity layer for an entire asset class. The data that powers faster, more accurate appraisals, greater pricing transparency, and a more efficient, trustworthy marketplace.

Chicago is a city where you can build both heavy operations and real tech under one roof. What would’ve been different about building UNICORN in NYC or SF, and how does that shape how you hire in Chicago?

PM: You couldn’t build this in a place that romanticizes either software or finance but looks down on operations. Our business lives at the intersection of warehouses, compliance, logistics, and data systems. Chicago lets you hire people who are fluent in execution and systems thinking. In New York or the Bay, you’d constantly be fighting the environment—either costs, talent expectations, or cultural bias against “unsexy” problems.

We hire for range. People who are comfortable switching contexts, from a loading dock to a dashboard to a customer conversation. Chicago talent tends to be pragmatic, loyal, and systems-oriented. There’s less ego and more pride in building something that actually works. That matters a lot when you’re building infrastructure, not just features.

Majority of transactions are under $250. Why focus on democratizing access vs leaning into high end exclusivity

PM: Because real marketplaces are built on participation, not exclusivity. If you only serve the top 1%, you get prestige—but not a real market. When you enable transactions at $100 or $200, you bring in new collectors, generate better data, and create repeat behavior.

That’s what builds a durable ecosystem. We’re not built on scarcity or status; we’re built on access and trust. The high end absolutely exists on UNICORN, but it’s healthier and more transparent because it’s supported by a much broader base of customers and participation.

Legacy auction houses left everyday bottles without a real home, pushing consumers into the gray market. We built a platform that feels just as welcoming to a first-time buyer as it does to a seasoned collector, because younger collectors want clarity, trust, and a marketplace that works at every price point.

With The Unicorn Review, you’re moving into content and education. What made this the logical next step

PM: Because markets mature when participants are educated. The industry has long been intimidating for newcomers and difficult to navigate even for seasoned collectors. We sit on an enormous amount of insight about pricing, trends, and behavior, and it felt irresponsible to keep that locked inside the platform.

The Unicorn Review is about giving people the tools to navigate the market and collect with confidence—whether or not they transact with us tomorrow. Long-term trust is built through shared understanding.

Today consumers are more intentional with spending. At a macro level, how do you see collecting, resale, and “liquid assets” changing as people rethink consumption more broadly

PM: People are moving away from disposable consumption and toward things that hold value—or at least don’t go to zero. Collecting is becoming more rational. Buyers care about exit value, price history, and liquidity, not just aesthetics. Over time, I think more categories will be treated like assets, and platforms that provide transparency and resale will outperform those built purely on hype.

🎓 A Pivotal Transition at UChicago’s Graduate Bridge Program

As the lines between business and technology blur, business professionals are leveraging innovative educational programs to carve paths into specialized technical fields.

Cole Simner’s journey illustrates this career pivot. With his undergraduate business degree still fresh, Cole landed a role at a major tech company that ignited an enthusiasm for the industry’s technical foundations and research frontiers.

With experience in tech consulting and product management, Cole had the drive but lacked the formal STEM education he believed was crucial to competing for senior technical roles. The Graduate Student-at-Large (GSAL) program at the University of Chicago offered him an ideal solution: a flexible pathway to build the skills he needed while exploring graduate-level computer science education.

GSAL gave Cole access to a wide range of courses and allowed him to explore various areas of the field while building the academic foundation he needed.

“Taking advantage of the GSAL program allowed me to not only build those skills and put those courses on my resume but also demonstrate that I could do graduate engineering coursework coming from the background that I had, and more importantly, I could do it at UChicago.”

Working closely with GSAL’s team of advisors, Cole was able to craft a tailored academic plan that included enrolling in courses spanning computational mathematics, data engineering, and natural language processing. This approach let him explore different areas of computer science and data science and helped him refine his interests and goals.

Today, as a product lead for Capital One’s ML platform and a student in the MPCS program, Cole credits GSAL with setting him on this path. “The GSAL program has been one of the best things for my career and personal journey since I graduated from college.

📅 Who’s Hosting This Week

ZoCo Product Invitational

Hosted by Drive Capital and ZoCo Design

Thursday January 29th

Startup Grind Chicago Food Bash

Wednesday January 28th

RSVP (3 free tickets available first come first serve with code Landon)