✍🏽 Welcome to Landon’s Loop: your weekly read on Chicago startups!

In this week’s edition #137:

- The significance of the CME shortage from last week

- 4 tech events in Chicago this week

- Upcoming AI Builders Day next week

Why CME Markets Went Offline

Last week (the day before Thanksgiving) a chiller plant failure at the CyrusOne CHI1 data center in Aurora, Illinois triggered a massive thermal warning forcing a hard stop on global futures trading.

For 10ish hours, the outage severed the connection to the CME Globex platform, causing markets from S&P 500 and Treasury futures to Crude Oil and Bitcoin to stop.

Thankfully this all happened during a lower volume holiday window, but it was still a big deal.

The CME handles over 26 million contracts a day, which represents trillions in value.

CME History

To understand the severity of this event, you have to understand the geography of the CME.

The exchange started in 1898 as the Chicago Butter and Egg Board. It was a spot market where local merchants traded perishable goods like butter, eggs, poultry, and potatoes. It served as a way to standardize prices, enforce quality, and bring order to a chaotic agricultural market.

As trading volume grew, the Board created formal rules, clearing processes, and membership structures that laid the groundwork for modern futures markets.

By 1919 it reorganized into the Chicago Mercantile Exchange, expanding beyond farm products and setting up the institution that would eventually evolve into today’s electronic, globally connected CME Group.

But over the last 30 years, what once happened on a trading floor now happens inside a server fortress in the western suburbs.

When CME sold its Aurora data center to CyrusOne in 2016, it kept its Globex matching engine which was the crown jewel of the operation. They kept it physically located there.

That engine is the single heartbeat for contracts tied to global interest rates, equity indexes, and energy markets.

The Outage

The outage was caused by a mechanical failure in the facility’s cooling infrastructure when multiple cooling units went offline at one time.

To protect the hardware from permanent heat damage, the systems were forced to shut down.

When the CHI1 facility overheated, there was no alternative venue. Markets in Asia and Europe were left waiting in the dark, unable to hedge positions or manage risk.

A 10 hour pause before a holiday is an inconvenience, the same outage on a volatile trading day would have been a catastrophe.

Why This Matters for Chicago

Chicago has always been a city of heavy infrastructure, from railroads to stockyards.

Today that infrastructure is digital.

Illinois has become a premier global data center market, driven by reliable nuclear power, strong tax incentives, and the financial sector’s demand for "low latency" AKA the need to be physically close to the matching engine in Aurora.

As AI demand surges and financial models rely on heavier computation, the pressure on power, cooling, and backup systems will only intensify.

The Aurora incident made one thing clear: Chicago is a modern compute hub, and the global economy depends on these machines staying cool.

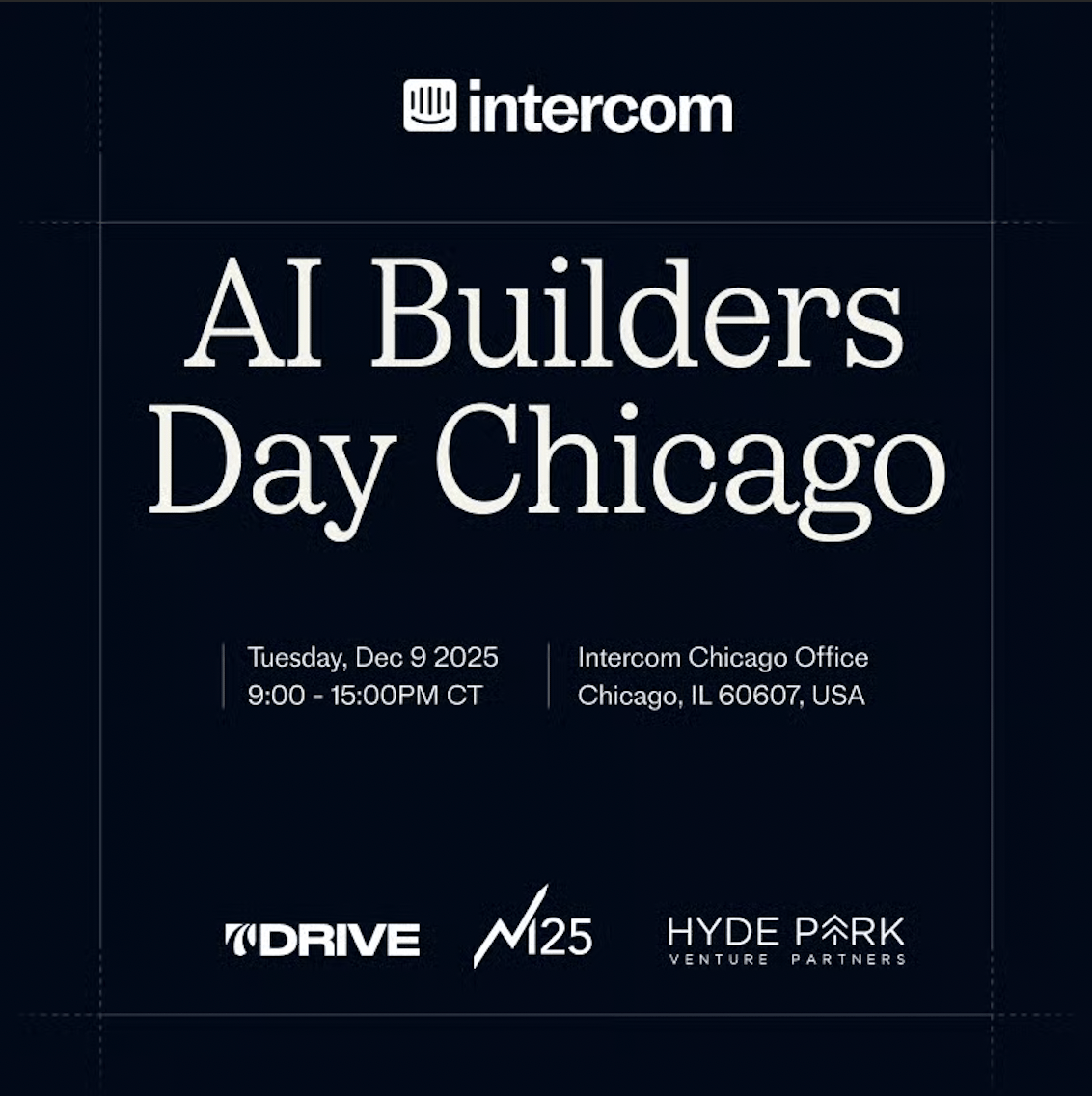

AI Builder Day Chicago

I’m partnering with Intercom to help bring AI Builders Day Chicago to life!

Join us next week on December 9th at the Intercom Chicago office for fireside chats, networking, and working sessions:

Run ads IRL with AdQuick

With AdQuick, you can now easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at www.AdQuick.com

📆 This Week’s Tech Events

A Conversation with Kevin Boehm

Tuesday

Health2Tech Chicago

Wednesday

AGI When Will We Reach It? If Ever?

Wednesday

1 Million Cups Chicago

Wednesday